The surging popularity of cryptocurrencies like Bitcoin and Ethereum has introduced a new frontier for investors. But cryptocurrencies reside on decentralized blockchains unlike traditional stocks and bonds held in brokerage accounts. This unique environment necessitates a specialized tool for secure storage and management: the crypto wallet.

What exactly is a crypto wallet? It’s not a digital equivalent of your leather billfold. Instead, crypto wallets securely store the private keys, acting like digital passports that grant access to your cryptocurrency holdings on the blockchain. Imagine a secure vault – the blockchain – where your crypto resides, and your private key is the unique code that unlocks it.

Why is choosing the right type of crypto wallet critical? With the global cryptocurrency market exceeding a staggering $2 trillion mark in market capitalization as of June 2024, the security of your digital assets is paramount. A compromised wallet can lead to devastating losses, highlighting the importance of selecting the type of crypto wallet that best aligns with your security needs and investment goals.

This comprehensive guide will equip you with the knowledge to navigate the world of crypto wallets. We’ll explore the various options available, their advantages and drawbacks, empowering you to make informed decisions about safeguarding your valuable crypto holdings.

Understanding Crypto Wallets

The cryptocurrency landscape has exploded in recent years, attracting a new generation of investors eager to tap into this innovative asset class. However, unlike traditional stocks and bonds held within brokerage accounts, cryptocurrencies reside on decentralized blockchains, presenting a unique challenge: secure storage. This is where crypto wallets enter the scene, acting as the cornerstone of any crypto investor’s toolkit.

But what exactly are crypto wallets, and how do they function? Let’s delve into the world of digital asset security and equip you with the knowledge to navigate this crucial aspect of cryptocurrency ownership.

Definition and Purpose of Crypto Wallets

Forget the familiar leather wallets you carry around. Crypto wallets are not designed to hold your actual cryptocurrency. Instead, they function as secure vaults for the digital keys that grant access to your holdings on the blockchain.

Imagine a vast, distributed ledger (the blockchain) where your crypto resides, and your crypto wallet stores the unique password (private key) that unlocks it for transactions.

In simpler terms, crypto wallets don’t store the crypto itself, but rather the credentials that prove your ownership and allow you to interact with your digital assets on the blockchain network.

Here’s a breakdown of the key functions of a crypto wallet:

- Secure storage of private keys: These act as your master passwords, granting access to your crypto holdings.

- Sending and receiving cryptocurrency: Wallets provide a user-friendly interface to initiate and manage crypto transactions.

- Interaction with decentralized applications (dApps): Many wallets allow users to connect with dApps built on specific blockchains, expanding the functionality of your crypto holdings.

How Crypto Wallets Work: Keys to Your Crypto Kingdom

Understanding the concept of private keys is fundamental to grasping how crypto wallets work. These keys are long strings of complex characters that act as cryptographic signatures, proving your ownership of a specific blockchain address where your crypto resides.

Think of it like this: Every house has a unique address, and to enter, you need a key. Similarly, each blockchain address has a corresponding private key that unlocks it and allows you to spend the crypto associated with that address.

Crypto wallets securely store your private keys and often generate a secondary layer of security with public keys. Public keys are essentially like your house address – anyone can see it, but only someone with the corresponding private key (your house key) can gain access.

Here’s a crucial point to remember: Never share your private key with anyone. Granting access to your private key is akin to handing over the keys to your crypto vault.

Private Keys vs. Public Keys

As mentioned earlier, crypto wallets manage both private and public keys. Let’s explore the key differences between these two:

- Private Keys: These are highly sensitive, top-secret codes that should be kept confidential at all costs. Sharing your private key is akin to giving someone complete control over your crypto holdings.

- Public Keys: These are essentially your crypto wallet’s public address. They can be shared freely, as they only allow others to see your account balance and send you crypto, but not withdraw it.

In essence, private keys are like your secret PIN for an ATM, while public keys are similar to your account number – one grants access, while the other identifies you.

By understanding the role of crypto wallets, private keys, and public keys, you gain a firm grasp on how to securely store and manage your digital assets in the exciting world of cryptocurrency.

This is just the first step on your crypto wallet journey. Stay tuned for the next part of this series, where we’ll explore the different types of crypto wallets available and how to choose the one that best suits your needs!

Main Categories of Crypto Wallets

In the previous part of our crypto wallet series, we explored the fundamental concepts of these digital security tools. We established that crypto wallets don’t store your cryptocurrency itself, but rather the crucial private keys that grant access to your holdings on the blockchain.

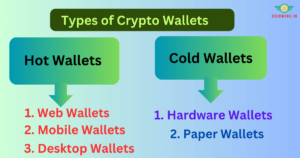

Now, let’s delve deeper and explore the two main categories of crypto wallets: hot wallets and cold wallets. We’ll also unpack the distinction between custodial and non-custodial wallets, empowering you to make informed decisions about securing your valuable crypto assets.

Hot Wallets vs. Cold Wallets

The primary distinction between hot wallets and cold wallets lies in their internet connectivity.

- Hot Wallets: These are software-based wallets that reside on internet-connected devices like smartphones, computers, or web browsers. Their constant online connection provides convenience and ease of use. Imagine having your crypto readily accessible at your fingertips, allowing for quick transactions and interaction with decentralized applications (dApps). Popular examples of hot wallets include mobile apps like MetaMask or browser extensions like Coinbase Wallet.

Here are some key advantages of hot wallets:

- Accessibility: Easy to access and manage your crypto on the go.

- User-friendly interface: Designed for ease of use, often resembling familiar mobile banking apps.

- Integration with dApps: Many hot wallets allow interaction with decentralized applications built on specific blockchains.

However, the constant internet connection of hot wallets presents a potential security vulnerability. If a hacker gains access to your device or the platform where the wallet resides, your crypto holdings could be at risk.

- Cold Wallets: These prioritize security by storing your private keys offline on a physical device that is not connected to the internet. Common examples include hardware wallets like Ledger Nano S or Trezor Model One. Think of them as secure vaults for your private keys, offering an extra layer of protection against online attacks.

Cold wallets boast significant security advantages:

- Offline storage: Minimizes the risk of hacking as your private keys are never exposed to the internet.

- Enhanced security features: Many hardware wallets offer additional security measures like PIN codes and two-factor authentication.

However, cold wallets may present some drawbacks:

- Less convenient: Transactions can be a slower process compared to hot wallets as you need to physically connect the device to your computer.

- Potential for loss or damage: Losing your hardware wallet or damaging it could result in permanent loss of access to your crypto.

Ultimately, the choice between a hot wallet and a cold wallet depends on your individual needs and risk tolerance. If you plan on actively trading your cryptocurrency, a hot wallet might be more suitable for its convenience. However, for long-term storage of larger crypto holdings, a cold wallet offers superior security.

Here’s a helpful tip: Consider using a combination of both hot and cold wallets. Store the bulk of your holdings in a secure cold wallet and keep a smaller amount readily available for transactions in a hot wallet.

Custodial vs. Non-Custodial Wallets

Another critical factor to consider when choosing a crypto wallet is the concept of custodial vs. non-custodial wallets. This distinction revolves around control over your private keys.

- Custodial Wallets: These are offered by cryptocurrency exchanges or custodial service providers. With a custodial wallet, the exchange holds onto your private keys for you. This provides a user-friendly experience similar to traditional online banking, but it also means relinquishing control over your crypto assets. In essence, you’re trusting the custodian to keep your private keys safe. A popular example of a custodial wallet is the one offered by Coinbase.

Here are some potential advantages of custodial wallets:

- Convenience: Similar to a traditional bank account, the custodian handles the security of your private keys.

- User-friendly interface: Designed for ease of use, often resembling familiar mobile banking apps.

- Recovery options: Some custodial services offer recovery options in case you lose your login credentials.

However, custodial wallets come with inherent drawbacks:

- Loss of control: You don’t have direct control over your private keys, which could be a concern for some investors.

- Vulnerability to exchange hacks: If the exchange where your custodial wallet resides is hacked, your crypto holdings could be at risk.

- Non-Custodial Wallets: These prioritize user control. With a non-custodial wallet, you hold onto your private keys yourself. This approach offers maximum security and control over your crypto assets, but it also places the responsibility for safekeeping entirely on your shoulders. Examples of non-custodial wallets include hot wallets like MetaMask and cold wallets like Ledger Nano S.

Here are some advantages of non-custodial wallets:

- Complete control: You retain full ownership and control over your private keys.

- Enhanced security: Minimizes the risk of hacking or theft, as your private keys are not stored on a third-party platform.

- Versatility: This can be used with a wide range of cryptocurrencies and decentralized applications.

non-custodial wallets require careful attention to security:

- Responsibility for safekeeping: You’re solely responsible for protecting your private keys.

- Potential for loss: Misplacing or losing your private keys could result in permanent loss of access to your crypto.

1 – Hot Wallets: Accessible and Convenient

In the previous part of our crypto wallet journey, we explored the two main categories of wallets: hot wallets and cold wallets. We also discussed the distinction between custodial and non-custodial wallets. Now, let’s delve deeper into the world of hot wallets, understanding their various forms and the advantages and disadvantages they present.

Hot wallets prioritize convenience and ease of use, making them ideal for investors who actively trade or interact with decentralized applications (dApps). However, due to their constant internet connection, they inherently carry a slightly higher security risk compared to cold wallets.

Here’s a breakdown of the three main types of hot wallets:

1. Web Wallets:

What are Web Wallets? Imagine a crypto bank account you can access from any web browser. Web wallets are hosted by online service providers, offering a user-friendly interface for managing your cryptocurrencies. They are particularly convenient for beginners due to their ease of use and accessibility from any device with an internet connection.

Pros:

- Accessibility: Easy to access and manage your crypto from any internet-connected device.

- User-friendly Interface: Often designed with a familiar and intuitive layout, making them ideal for beginners.

- Integration with dApps: Many web wallets allow interaction with decentralized applications built on specific blockchains.

Cons:

- Security Concerns: Since you don’t hold your private keys, you rely on the security measures of the web wallet provider. A hack on the platform could compromise your crypto holdings.

- Limited Functionality: Web wallets may have limitations on the number of cryptocurrencies they support or the features they offer compared to other hot wallet options.

Popular Web Wallets in the Market: Coinbase Wallet, MetaMask (functions as both a browser extension and mobile app wallet).

2. Mobile Wallets:

What are Mobile Wallets? Think of your crypto holdings readily available in your pocket! Mobile wallets are downloadable apps that allow you to store, send, and receive cryptocurrency directly from your smartphone or tablet. They offer an unmatched level of convenience for on-the-go crypto management.

Key Features of Mobile Wallets:

- Convenience and Accessibility: Manage your crypto holdings from anywhere with an internet connection on your phone.

- QR Code Integration: Many mobile wallets allow quick and easy transactions by scanning QR codes.

- Security Features: Most mobile wallets offer security features like PIN codes, two-factor authentication, and biometric authentication for added protection.

Top Mobile Wallet Apps for Crypto: MetaMask, Trust Wallet, Exodus.

3. Desktop Wallets:

What are Desktop Wallets? Installed directly on your computer, desktop wallets offer a balance between convenience and security compared to web and mobile wallets. While they require downloading software, they provide users with more control over their private keys compared to web wallets.

Advantages:

- Enhanced Security: Private keys are stored on your local machine, offering more control and potentially less risk compared to web wallets.

- Greater Functionality: Desktop wallets often offer advanced features like multi-signature support and integration with hardware wallets for enhanced security.

Disadvantages:

- Limited Accessibility: You can only access your crypto from the computer where the wallet software is installed.

- Vulnerability to Malware: If your computer is compromised by malware, your private keys could be stolen.

Best Desktop Wallets to Consider: Electrum, Exodus, Atomic Wallet.

Choosing the Right Hot Wallet

The ideal hot wallet for you depends on your individual needs and priorities. Here are some factors to consider:

- Security: Web wallets offer convenience but may have lower security. Desktop wallets provide more control but require good computer hygiene.

- Features: Consider which features are important to you, such as integration with dApps or multi-signature support.

- Ease of Use: If you’re a beginner, a web or mobile wallet might be a good starting point due to its user-friendly interface.

By understanding the different types of hot wallets and their pros and cons, you can make an informed decision about which one best suits your crypto storage needs.

remember, even with hot wallets, prioritize security by using strong passwords and enabling two-factor authentication whenever possible. In the next part of our crypto wallet series, we’ll explore cold wallets – the ultimate guardians of your digital assets!

2 – Cold Wallets: Secure and Reliable

In our previous dives into the world of crypto wallets, we explored the advantages and considerations of hot wallets – convenient for frequent transactions but with an inherent online vulnerability. Now, let’s shift gears and delve into the realm of cold wallets, the ultimate bastions of security for your most valuable crypto holdings.

Cold wallets prioritize one thing above all else: security. Unlike hot wallets that connect to the internet, cold wallets store your private keys offline, significantly reducing the risk of hacking or online theft.

Think of them as secure vaults for your crypto’s digital keys, offering an extra layer of protection for long-term storage or holdings you don’t trade frequently.

Here, we’ll explore the two main types of cold wallets – hardware wallets and paper wallets – and delve into their unique features and considerations.

1. Hardware Wallets:

What are Hardware Wallets? Imagine a sleek, USB-like device specifically designed to store your crypto private keys offline. Hardware wallets are physical devices that provide a secure environment for your private keys, completely isolated from the internet. They often resemble small flash drives and come equipped with a user-friendly interface for managing your crypto holdings.

Benefits of Using Hardware Wallets:

- Enhanced Security: Offline storage of private keys minimizes the risk of hacking or online attacks.

- Advanced Security Features: Many hardware wallets offer PIN codes, two-factor authentication, and even self-destruct mechanisms to protect your private keys in case of physical theft.

- Integration with Multiple Cryptocurrencies: Popular hardware wallets support a wide range of cryptocurrencies, allowing you to store various digital assets in one secure location.

Best Hardware Wallets for Security:

Based on my experience and industry reputation, here are some top contenders in the hardware wallet space:

* Ledger Nano S (known for its user-friendliness and affordability)

* Trezor Model One (offers a good balance of security and features)

* Coldcard (considered by some to be the most secure hardware wallet due to its open-source software)

Important Note: When considering a hardware wallet, prioritize buying directly from the manufacturer’s website to avoid potential security risks associated with third-party sellers.

2. Paper Wallets:

What are Paper Wallets? Imagine a physical document containing your public and private keys printed in a QR code format. Paper wallets are essentially pieces of paper where your crypto keys are securely stored offline. They are a low-cost option for cold storage, ideal for small crypto holdings or for those who value a truly air-gapped (completely offline) solution.

How to Create a Paper Wallet:

Some various online tools and services allow you to generate paper wallets. However, it’s crucial to ensure the tool you use is reputable and secure. Here’s a general process (remember, never use a tool or service you don’t trust):

1. **Access a reputable paper wallet generator website.**

2. **Download and run the tool offline on your computer (not connected to the internet).**

3. **Generate your private and public keys.**

4. **Print the paper wallet containing the QR codes for your keys.** **Crucially, store the printout in a safe and secure location.**

Risks and Considerations of Using Paper Wallets:

- Vulnerability to Physical Damage: If your paper wallet gets lost, destroyed, or falls into the wrong hands, your crypto holdings could be irretrievably lost.

- Technical Expertise Required: Creating and using paper wallets requires a certain level of technical knowledge and careful handling procedures.

Choosing the Right Cold Wallet

The ideal cold wallet solution depends on your individual needs and risk tolerance. Here are some factors to consider:

- Security: Hardware wallets offer a more robust security solution compared to paper wallets.

- Technical Expertise: Paper wallets require more technical knowledge to create and use compared to hardware wallets.

- Cost: Hardware wallets involve an upfront cost, while paper wallets are a free solution (aside from printing costs).

By understanding the different types of cold wallets, their advantages, and potential drawbacks, you can make an informed decision about the best way to securely store your valuable crypto assets. Remember, cold wallets are ideal for long-term holdings or holdings you don’t trade frequently. For everyday transactions, consider using a reputable hot wallet with strong security measures.

In the next part of our crypto wallet series, we’ll explore some best practices for keeping your crypto holdings safe, regardless of which wallet type you choose!

Custodial Wallets: Managed by a Third Party

In our crypto wallet journey so far, we’ve explored the contrasting worlds of hot wallets (convenience) and cold wallets (security). Now, let’s delve into the realm of custodial wallets, a category that prioritizes ease of use but comes with inherent trade-offs.

What are Custodial Wallets?

Imagine a familiar online banking experience but for your cryptocurrency holdings. Custodial wallets are provided by cryptocurrency exchanges or custodial service providers.

These platforms hold onto your private keys for you, similar to how a bank holds your traditional currency. This approach offers a user-friendly interface, making it easy to buy, sell, and manage your crypto assets without the technical complexities of private key management.

Advantages and Limitations of Custodial Wallets:

- Convenience: Similar to a traditional bank account, you don’t need to worry about remembering or safeguarding your private keys. Custodial wallets offer a familiar and easy-to-use interface for managing your crypto.

- Security Features: Reputable custodial service providers invest heavily in security measures to protect your crypto holdings. This can be particularly appealing to beginners who might be apprehensive about managing private keys themselves.

- Fiat Integration: Many custodial wallets allow you to easily buy and sell cryptocurrency using fiat currency (traditional money like USD or EUR), simplifying the process of entering and exiting the crypto market.

However, there are also limitations to consider:

- Loss of Control: By relinquishing control of your private keys, you’re essentially trusting the custodian to keep your crypto safe. A security breach on the custodial platform could compromise your holdings.

- Limited Functionality: Custodial wallets might have limitations on the features they offer compared to non-custodial wallets. For example, they might restrict your ability to stake certain cryptocurrencies or interact with decentralized applications (dApps).

- Potential Fees: Custodial service providers typically charge fees for transactions and account maintenance. These fees can vary depending on the platform.

Best Custodial Wallet Providers:

While the “best” provider depends on individual needs, here are some reputable custodial wallet options to consider (based on industry reputation and security practices):

- Coinbase: A user-friendly platform with a wide range of cryptocurrencies and features, but with potentially higher fees.

- Gemini: Known for its focus on security and regulatory compliance, offering a more limited selection of cryptocurrencies compared to Coinbase.

- Binance: A global leader in crypto exchanges, offering a vast array of cryptocurrencies and trading options, but may not be available in all regions due to regulatory restrictions.

Choosing the Right Custodial Wallet:

Custodial wallets can be a suitable option for beginners or investors who prioritize convenience and ease of use. However, it’s crucial to understand that you’re essentially trusting a third party with your crypto assets.

Here are some factors to consider when choosing a custodial wallet:

- Security: Research the platform’s security measures and track record.

- Fees: Compare transaction fees and account maintenance charges.

- Features: Consider the cryptocurrencies supported and any limitations on functionalities like staking or dApp integration.

Remember: Crypto exchanges and custodial service providers are constantly evolving. It’s essential to stay informed about the latest security practices and regulations before entrusting your crypto holdings to any platform.

In the next part of our crypto wallet series, we’ll explore non-custodial wallets – the path for investors who value complete control over their private keys and crypto assets.

Non-Custodial Wallets: You Own Your Keys

In the crypto world, control over your digital assets is paramount. In our previous explorations, we examined custodial wallets, which offer convenience but require relinquishing control of your private keys to a third party.

Now, let’s shift gears and dive into the realm of non-custodial wallets – the domain for investors who value complete autonomy over their crypto holdings.

What are Non-Custodial Wallets?

Imagine a secure vault where you hold the keys – literally and figuratively. Non-custodial wallets empower you to take full responsibility for your private keys, the critical piece of information needed to access your crypto on the blockchain. These wallets come in various forms, from software applications to physical devices, but the core principle remains the same: you are the sole guardian of your crypto’s security.

Benefits of Non-Custodial Wallets:

- Enhanced Security: By holding your private keys, you significantly reduce the risk of exchange hacks or custodial service breaches compromising your crypto holdings.

- Greater Control: You have complete autonomy over your crypto assets, including the ability to transfer them freely and interact with decentralized applications (dApps) without restrictions.

- Privacy: Non-custodial wallets don’t require extensive personal information for setup, offering a higher degree of financial privacy compared to custodial wallets.

However, with great power comes great responsibility! Here are some things to consider:

- Security Burden: The responsibility for safeguarding your private keys falls entirely on you. Losing your private keys could result in permanent loss of access to your crypto.

- Technical Knowledge: Using non-custodial wallets might require a bit more technical knowledge compared to custodial wallets. Understanding how to back up your private keys securely is crucial.

- Potential for Errors: Sending crypto from a non-custodial wallet is irreversible. There’s no customer support to rectify mistakes, so ensuring accurate transaction details is essential.

Popular Non-Custodial Wallets for Crypto Enthusiasts:

The world of non-custodial wallets offers a diverse landscape of options. Here are some well-regarded choices to consider:

- Hardware Wallets: Ledger Nano S and Trezor Model One are popular choices, offering offline storage and robust security features for your private keys.

- Mobile Wallets: MetaMask, a mobile app and browser extension wallet, allows for interaction with dApps and secure storage of your private keys on your mobile device.

- Desktop Wallets: Electrum, a user-friendly desktop wallet for Bitcoin, provides advanced features for experienced users who prioritize security.

Choosing the Right Non-Custodial Wallet:

The ideal non-custodial wallet depends on your technical expertise, risk tolerance, and crypto usage patterns. Here are some factors to weigh:

- Security: Hardware wallets offer the most robust security, while mobile and desktop wallets require a strong security posture on your device.

- Convenience: Mobile wallets prioritize accessibility, while desktop wallets offer a balance, and hardware wallets prioritize security over immediate access.

- Technical Expertise: If you’re a beginner, a mobile wallet with a user-friendly interface might be a good starting point. As you gain experience, you can explore hardware wallets for enhanced security.

Non-custodial wallets empower you with complete control over your crypto, but they also place the responsibility for security squarely on your shoulders. By understanding the trade-offs and choosing a wallet that aligns with your needs, you can embark on a self-directed journey in the exciting world of cryptocurrency.

Specialized Wallets for Specific Needs

In our crypto wallet odyssey, we’ve explored the core categories – hot wallets, cold wallets, custodial wallets, and non-custodial wallets. Now, let’s delve into the fascinating realm of specialized wallets that cater to specific needs and security requirements.

1. Multisignature Wallets

Imagine needing multiple keys to unlock a vault – that’s the essence of multi-signature wallets. These wallets require multiple private keys (usually 2 or 3) to authorize a crypto transaction, offering an extra layer of security for high-value holdings or situations where shared control is desired.

Use Cases for Multisignature Wallets:

- Shared Investments: Ideal for investment groups or family accounts where multiple approvals are required for spending.

- Business Transactions: Enhances security for company funds by requiring multiple authorized signatures for withdrawals.

- Inheritance Planning: This can be used to establish a secure way for heirs to access crypto assets upon inheritance.

Top Multisignature Wallet Providers:

Several popular hot and cold wallets offer multi-signature functionality. Here are a few examples:

* **Hardware Wallets:** Ledger Nano S and Trezor Model One (with additional firmware updates)

* **Desktop Wallets:** Electrum (multisignature setup requires some technical expertise)

* **Mobile Wallets:** Casa (multisignature mobile app with a focus on ease of use)

2. Hardware Wallets with Multi-Currency Support

The crypto landscape is teeming with various digital assets. For investors who hold a diversified portfolio, a hardware wallet with multi-currency support can be a game-changer. These secure devices allow you to store the private keys for multiple cryptocurrencies in one place, eliminating the need for separate wallets for each asset.

Why Multi-Currency Support Matters:

- Convenience: Manage all your crypto holdings in a single secure location.

- Security: Hardware wallets prioritize offline storage, minimizing the risk of online attacks for all your crypto assets.

- Cost-Effectiveness: This avoids the need to purchase multiple hardware wallets for different cryptocurrencies.

Best Multi-Currency Hardware Wallets:

The market offers several robust hardware wallets with multi-currency support.

* **Ledger Nano X:** Supports a vast array of cryptocurrencies, making it a versatile choice for diverse portfolios.

* **Trezor Model T:** Offers a user-friendly interface and supports a wide range of cryptocurrencies, with more tokens being added regularly.

* **SecLedger Stone Cold Wallet:** Provides top-tier security features and multi-currency support for a premium price.

choosing the Right Specialized Wallet

When considering specialized wallets, carefully evaluate your specific needs. Here are some questions to ponder:

- Do I require shared control for my crypto holdings (multi-signature)?

- How many different cryptocurrencies do I hold (multi-currency)?

- What level of security and user-friendliness do I prioritize?

By understanding the functionalities of specialized wallets and aligning them with your crypto storage requirements, you can make informed decisions for a secure and efficient crypto experience.

In the thrilling world of cryptocurrency, security is paramount. Your crypto wallet acts as the digital vault for your hard-earned coins, and choosing the right one with robust security features is essential. In this guide, we’ll explore the key security elements to consider when selecting a crypto wallet and offer tips to further enhance your wallet’s defenses.

Importance of Security in Crypto Wallets:

Unlike traditional bank accounts with FDIC insurance, crypto holdings are your sole responsibility. A security breach or loss of access to your private keys can result in permanent loss of your crypto assets. Here’s a stark statistic to remember: According to Chainalysis, over $13 billion worth of cryptocurrency was stolen in hacks and scams in 2021 alone.

By prioritizing security features in your chosen wallet, you significantly reduce the risk of falling victim to cyberattacks or losing access to your crypto.

Key Security Features to Look For:

- Private Key Management: This is the heart of crypto security. Look for wallets that give you complete control over your private keys. Avoid custodial wallets that hold your keys for you, as this introduces a single point of failure.

- Strong Encryption: Encryption scrambles your data, making it unreadable to anyone without the decryption key. Look for wallets that utilize industry-standard encryption algorithms like AES-256.

- Two-Factor Authentication (2FA): This adds an extra layer of security by requiring a second verification factor, like a code from your phone, in addition to your password when logging in or making transactions.

- Multisignature Support (Optional): For high-value holdings or situations requiring shared control, consider wallets with multisignature functionality. These require multiple private keys to authorize a transaction, offering enhanced security.

- Regular Security Updates: A reputable wallet provider will prioritize ongoing security improvements. Choose a wallet with a history of prompt updates to address vulnerabilities.

Tips for Enhancing Wallet Security:

- Strong and Unique Passwords: Create complex passwords using a combination of uppercase and lowercase letters, numbers, and symbols. Avoid using the same password for your crypto wallet as you do for other online accounts.

- Beware of Phishing Attacks: Never click on suspicious links or enter your private key information on untrusted websites. Phishing scams often try to trick you into revealing your credentials.

- Download from Official Sources: Always download your wallet software directly from the developer’s website. Avoid downloading from third-party sources that could harbor malware.

- Back-Up Your Keys Securely: In case of hardware failure or loss of your device, having a secure backup of your private keys is crucial. Recovery phrases (seed phrases) are often used for this purpose. Store your backup phrase offline and never share it with anyone.

- Stay Informed: The crypto landscape is constantly evolving, and so are security threats. Stay updated on the latest security best practices to keep your crypto holdings safe.

By understanding the importance of security features and implementing these additional security tips, you can significantly reduce the risk of compromising your crypto wallet and safeguarding your valuable digital assets.

Remember: Security is an ongoing process. By following these guidelines and staying vigilant, you can navigate the exciting world of cryptocurrency with confidence.

Backup and Recovery Options for Crypto Wallet

In the realm of cryptocurrency, your wallet serves as the digital vault for your hard-earned coins. But unlike a traditional bank with FDIC insurance, the responsibility for securing your crypto holdings falls entirely on you. This is where backups and recovery strategies become crucial. Imagine losing your phone with your mobile wallet app – without a proper backup, your crypto could be irretrievably lost.

Importance of Backup and Recovery:

- Prevents Permanent Loss: Hardware failure, lost devices, or software malfunctions can render your wallet inaccessible. A secure backup ensures you can recover your crypto even in such scenarios.

- Peace of Mind: Knowing you have a recovery plan in place allows you to navigate the crypto world with greater confidence.

How to Backup Different Types of Wallets:

1 – Hardware Wallets: These secure devices typically provide recovery seed phrases – a series of random words that act as the master key to your crypto. Write down your recovery phrase on a piece of paper and store it in a safe and secure location, separate from your hardware wallet. Never store your recovery phrase digitally or share it with anyone.

2 – Software Wallets (Hot Wallets): Backup options can vary depending on the specific wallet. Some offer private key downloads, while others might use mnemonic phrases similar to hardware wallet recovery seeds. Always follow the specific instructions provided by your chosen wallet for secure backup.

3 – Paper Wallets: These are printed pieces of paper containing your private and public keys in QR code format. While a low-cost option, paper wallets are susceptible to physical damage or loss. Consider laminating your paper wallet for added protection and store it in a safe location.

Best Practices for Recovering Lost Wallets:

- Plan Ahead: Don’t wait for a crisis to create a backup plan. When you set up your wallet, prioritize creating a secure backup and storing it in a safe place.

- Test Your Recovery: Some wallets allow you to test your recovery phrase to ensure it works before an actual emergency. This is a valuable practice to confirm your backup’s functionality.

- Double-Check Everything: Typos or errors during backup can render your recovery process futile. Always double-check your written recovery phrases or private keys for accuracy.

- Never Share Your Recovery Information: Your recovery phrase or private key is akin to the master key to your crypto holdings. Never share this information with anyone, including customer support representatives. Legitimate support channels will never ask for your private keys.

Remember: Security is an ongoing process in the ever-evolving world of cryptocurrency. By implementing a robust backup and recovery strategy, you can significantly reduce the risk of losing access to your valuable crypto assets.

Here are some additional tips to consider:

- Multiple Backups: For added security, consider creating multiple backups of your recovery information and storing them in separate locations.

- Disaster Planning: Think about what might happen in case of a fire, flood, or other disaster. Would your backup be safe? Consider fireproof safes or cloud storage solutions (with strong encryption) for extra protection.

By following these guidelines and prioritizing a secure backup strategy, you can ensure your crypto holdings remain accessible and safe, allowing you to navigate the exciting world of cryptocurrency with confidence.

Choosing the Right Crypto Wallet for Your Needs

Choosing the right crypto wallet is crucial to your digital financial journey. The wrong choice can leave your hard-earned crypto vulnerable to theft or loss. Don’t worry, as this guide will equip you with the knowledge to navigate the different types of crypto wallets and choose the one that suits your needs.

Factors to Consider:

- Security: This is paramount. Look for wallets with robust security features like multi-factor authentication (MFA) and strong encryption to keep your private keys safe.

- Supported Cryptocurrencies: Not all wallets support all cryptocurrencies. Ensure your chosen wallet holds the coins you own or plan to invest in.

- User-friendliness: Consider your technical expertise. Some wallets offer a sleek, user-friendly interface, while others cater to more advanced users with advanced features.

- Transaction Fees: Some wallets charge fees for sending or receiving crypto. Compare fees across different options to find one that fits your budget.

- Additional Features: Do you plan on staking your crypto or interacting with DeFi applications? Look for wallets that offer these functionalities.

Wallet Selection Based on User Needs:

Now that you’re armed with these factors, let’s explore how different user profiles might approach choosing a crypto wallet:

- Beginners: For those new to crypto, a user-friendly mobile wallet like MetaMask or Trust Wallet might be a great starting point. They offer a simple interface and often integrate with popular crypto exchanges for easy initial purchases.

- Active Traders: If you’re a frequent trader, a desktop wallet like Exodus or Electrum might be ideal. These offer more advanced features and potentially lower fees compared to mobile wallets.

- Long-Term Investors: For those holding crypto for the long haul, security is paramount. A hardware wallet like Ledger Nano S or Trezor Model T is the most secure option. These store your private keys offline, making them virtually impenetrable to hackers.

Comparison for Beginners vs. Experienced Users:

| Feature | Beginner | Experienced User |

|---|---|---|

| Security | Medium | High |

| User-friendliness | High | Medium |

| Supported Cryptocurrencies | Limited | Wide Variety |

| Transaction Fees | May be higher | May be lower |

| Additional Features | Basic | Advanced (Staking, DeFi) |

| Recommended Wallets | Mobile wallets (MetaMask, Trust Wallet) | Desktop wallets (Exodus, Electrum), Hardware wallets (Ledger, Trezor) |

this is just a starting point! Many excellent wallets exist, and your specific needs will dictate the best choice. Always conduct thorough research and consider user reviews before selecting your crypto wallet.

Bonus Tip: Don’t put all your crypto eggs in one basket! Consider using a combination of wallets based on your security needs and activity level.

Common Mistakes to Avoid When Using Crypto Wallets

As a crypto enthusiast myself, I’ve seen countless newcomers fall victim to common mistakes. Here are some crucial tips to help you navigate the crypto landscape with confidence and avoid these costly errors:

1 – Phishing Attacks: Don’t Be a Catch!

Phishing scams are a constant threat in the digital world, and crypto wallets are a prime target. Imagine receiving an email that appears to be from your chosen wallet provider, urging you to “verify your account” or “claim a free bonus.” Clicking a suspicious link in such an email could lead to a fake website designed to steal your private key – the key to accessing your crypto. Here’s how to stay safe:

- Double-check website addresses: Always verify the URL before entering your login credentials. Legitimate websites will have a secure connection indicated by a lock symbol and “https” in the address bar.

- Never share your private key: No legitimate wallet provider will ever ask for your private key via email or message. Treat your private key like your bank PIN – keep it confidential!

- Enable multi-factor authentication (MFA): Most wallets offer MFA, an extra layer of security that requires a code from your phone or another device besides your password. This makes it much harder for hackers to gain access, even if they steal your login credentials.

2 – Private Key Peril: Keep it Safe, Keep it Secret!

Your private key is the master key to your crypto holdings. Losing it is akin to losing access to your digital safe. Here’s how to avoid this critical mistake:

- Never store your private key online: Don’t write it down on a document saved to your computer or store it in a cloud storage service. These are vulnerable to hacking.

- Hardware wallets are your friend: Consider using a hardware wallet like a Ledger Nano S or Trezor Model T. These devices store your private key offline, making them virtually impenetrable to online attacks.

- Seed phrase backup is essential: If you don’t use a hardware wallet, write down your seed phrase (a recovery phrase for your private key) on a piece of paper and store it securely in a fireproof and waterproof location.

3 – Understanding Wallet Fees: Don’t Get Nickled and Dimed!

Transaction fees are a fact of life in the crypto world. However, understanding the different types of fees associated with your crypto wallet can save you money in the long run. Here’s a breakdown:

- Network fees: These are fees paid to miners or validators on the blockchain network to process your transaction. These fees can fluctuate depending on network congestion.

- Wallet fees: Some wallets charge additional fees for sending or receiving crypto. Be sure to research the fee structure of your chosen wallet before making any transactions.

- Exchange fees: If you’re buying or selling crypto through your wallet provider, they might charge exchange fees on top of network fees. Compare fees across different platforms before making a trade.

Bonus Tip: Stay informed! Regularly check for updates and security patches for your chosen crypto wallet. Hackers are constantly evolving their tactics, so staying updated ensures your wallet remains secure.

As the founder of CoinWire.in, I strongly believe in empowering crypto users with the knowledge they need to thrive in this exciting space. By sharing my experience and insights, I hope to equip you with the tools to avoid common mistakes and safeguard your valuable crypto assets.

Future Trends in Crypto Wallet Development

The world of cryptocurrencies is constantly evolving, and crypto wallets, the gateways to this digital ecosystem, are keeping pace. As a crypto enthusiast, I have witnessed the remarkable journey of crypto wallets – from basic storage solutions to feature-rich platforms. But the future holds even more exciting possibilities. Let’s dive deeper into the evolution of crypto wallets and explore the emerging trends that will shape their future:

The Evolution of Crypto Wallets:

- Early Days (2009-2015): The first crypto wallets were simple software applications with basic functionalities like sending, receiving, and storing Bitcoin. Security was a major concern, with early wallets susceptible to hacking attempts.

- Mobile Boom (2015-2020): The rise of mobile devices led to a surge in user-friendly mobile wallets like MetaMask and Trust Wallet. These offered convenient access to crypto on the go, attracting a wider audience.

- Security Focus (2020-Present): With the increasing value of crypto assets, security became paramount. Hardware wallets like Ledger and Trezor emerged, offering offline storage and robust security features.

Emerging Trends and Innovations:

- Integration with DeFi (Decentralized Finance): As DeFi applications gain traction, crypto wallets are evolving to integrate with them seamlessly. This allows users to manage their crypto assets, stake their tokens, and access DeFi services directly from their wallets.

- Interoperability: Currently, many wallets only support specific blockchains. The future lies in interoperable wallets that allow users to hold and manage crypto assets across multiple blockchains. Imagine a single wallet for your Bitcoin, Ethereum, and Solana holdings!

- AI-Powered Security: Artificial intelligence is finding its way into crypto wallets, offering advanced features like anomaly detection and fraud prevention. This will further enhance the security of crypto transactions.

- Biometric Authentication: Fingerprint and facial recognition technology can offer a more convenient and secure way to access your crypto wallet, replacing traditional passwords.

- Focus on Usability: User experience is becoming a top priority. We can expect wallets with intuitive interfaces, educational resources, and built-in support mechanisms for a smoother user journey.

Predictions for the Future of Crypto Wallets:

- Wallets as Gateways: Crypto wallets are poised to become the central hub for managing all your digital assets. Imagine a single wallet for your crypto, NFTs, and even digital identity!

- Increased Regulation: Regulatory frameworks for crypto are still evolving. As regulations become more clear, we might see compliance features integrated into wallets for a more secure and transparent ecosystem.

- Focus on Sustainability: The environmental impact of certain blockchains is a growing concern. Green initiatives like energy-efficient protocols might be implemented in future wallets.

Staying Ahead of the Curve:

The future of crypto wallets is brimming with possibilities. By staying informed about these trends and innovations, you can choose a wallet that best suits your evolving needs and helps you navigate the ever-changing crypto landscape with confidence. Remember, as the founder of CoinWire.in, I’m dedicated to providing you with the latest information and insights to empower your crypto journey.

Want to learn more? Explore user reviews and expert opinions on popular crypto wallets to find the perfect fit for you. This, combined with staying updated on the latest trends, will ensure you make informed decisions about managing your digital assets in the exciting world of cryptocurrency.

Conclusion

The world of crypto wallets offers a diverse landscape, catering to various needs and security preferences. We’ve explored the main categories:

- Hot wallets: Convenient and accessible, but potentially less secure due to their online nature. Popular options include web wallets like MetaMask and mobile wallets like Trust Wallet.

- Cold wallets: Prioritize security by storing your private keys offline. Hardware wallets like Ledger and Trezor offer the highest level of protection, while paper wallets provide a more rudimentary solution.

We’ve also delved into custodial and non-custodial wallets, highlighting the trade-off between convenience and control. Ultimately, the right choice depends on your circumstances.

Choosing the right crypto wallet is not a one-size-fits-all proposition. As the founder of CoinWire.in, I’ve seen countless users make informed decisions by carefully considering factors like:

- Security: How much do you prioritize protection against theft or loss?

- Convenience: How easily do you want your crypto to be accessible?

- Features: Do you need functionalities like staking or dApp interaction?

- Experience Level: Are you a beginner or a seasoned crypto user?

By understanding the different types of wallets and their strengths and weaknesses, you can make an informed decision that safeguards your digital assets.

Remember, security should always be a top priority. Utilize strong passwords, enable multi-factor authentication wherever possible, and keep your software up-to-date. Regularly back up your private keys or seed phrases following secure practices.

The world of cryptocurrency is constantly evolving, and crypto wallets are keeping pace. By staying informed about the latest trends and innovations, you can ensure your chosen wallet continues to meet your needs and offers the best possible security for your valuable crypto holdings.

Managing your cryptocurrencies securely requires a blend of knowledge and vigilance. This guide has equipped you with the essential information to navigate the world of crypto wallets with confidence. Now, explore the exciting possibilities of the crypto space, all while keeping your digital assets safe!

For more information on trading please visit: stockdhan.com